how are property taxes calculated at closing in florida

This way when a tax bill arrives the parties involved in a real estate transaction should re-prorate the taxes to determine which party owes what. 097 of home value.

7 Tips For First Time Home Buyers Home Buying Process First Time Home Buyers Home Ownership

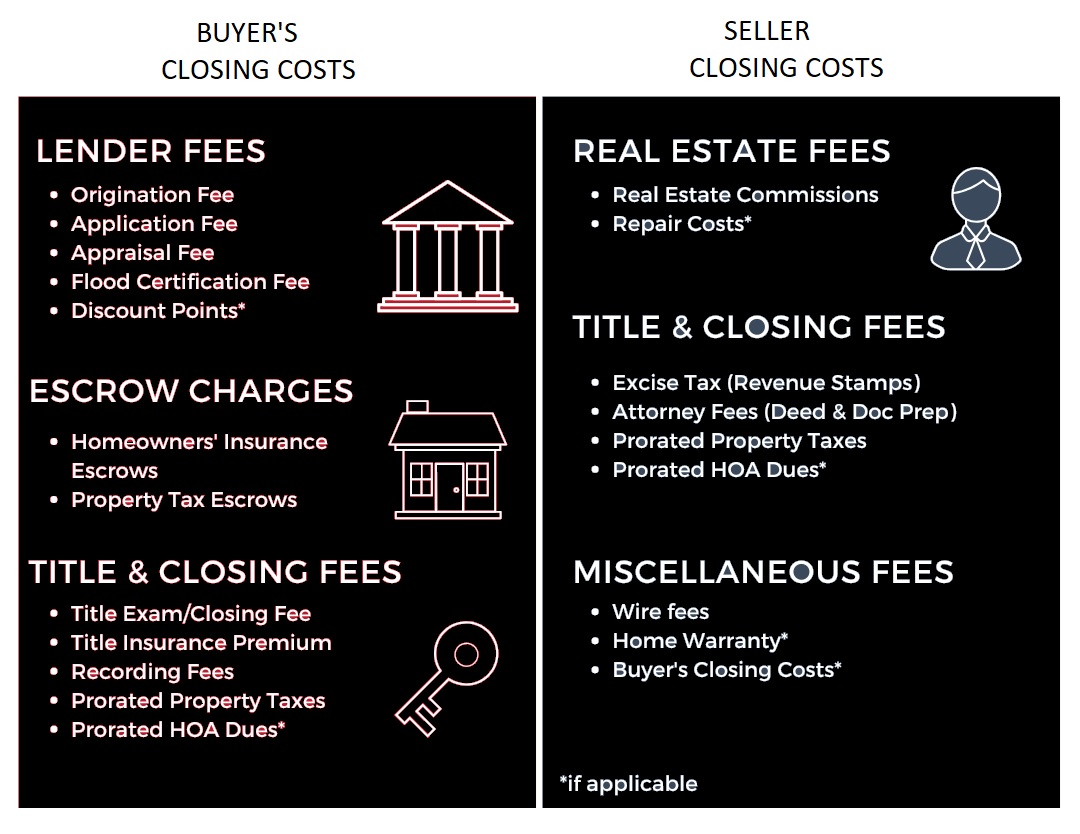

The actual closing costs will depend heavily on the property cost associated fees whether or not a real estate agent was involved and more.

. Real Estate Agent Commission typically 5-6 of the sales price. Based on those numbers getting the per diem ie the per day amount for our calculations is easy divide 477965 by 365 130949day. The taxes are assessed on a calendar year from Jan through Dec 365 days.

In Florida the transfer tax is usually paid by the seller. With respect to how property taxes are handled and paid at the closing in Florida effectively the property taxes are paid by the seller through the date of the closing in Florida. Assuming you intend to leverage the expertise of a qualified realtor and the buyer also engages an agent to purchase your home youll be responsible for paying both of them at closing.

This amount can differ greatly from one agent to another but it is typically. The seller will pay between 5 and 10 of the overall homes sale price largely due to real estate commission which can be as high as 6. The average closing costs for Florida in 2021 were 8551 with taxes and 4484 without taxes according to ClosingCorp.

The only exception is Miami-Dade County. While observing constitutional limitations prescribed by statute the city creates tax rates. Property Taxes In Florida these are paid in arrears which is to say one year behind.

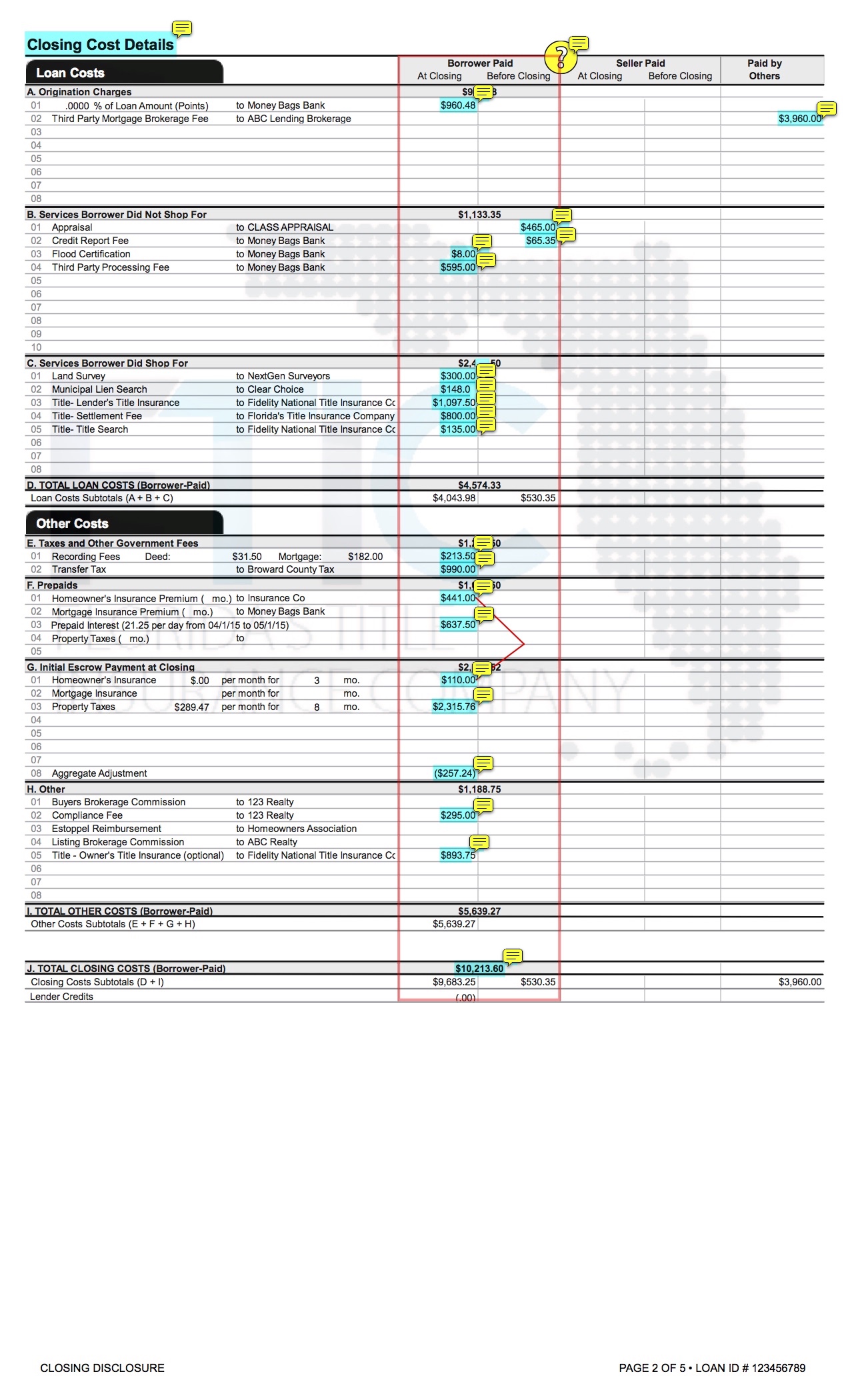

Property taxes in Florida are implemented in millage rates. Since the closing date does not line up with the exact date a property tax bill is due the property taxes are pro-rated between the buyer and seller based on the date of the closing. The closing can even be negotiated.

So when a home closes before the property tax bill arrives the title company will need to prorate taxes based on what the taxes were in the prior year. Real property evaluations are carried out by the county. Property tax bills in Florida arrive in early November and are for the calendar year.

Florida seller closing costs will be around 625 to 90 of the homes final sale price that includes real estate agent commissions. To learn more about how we can make your closing the best experience possible contact Key Title Escrow today by calling locally at 305 235-4571 or toll free at 800 547-0006. These costs depend on the homes value and its location.

However a good rule of thumb is to assume that. You could pay for this expense and then ask your seller or builder for. In Florida similarly to other states closing costs are charges that applied to both parties in a real estate transaction the buyer AND the seller.

Youll pay around 16 of your homes final sale price in seller closing costs when you sell a home in Florida. Real property taxes are paid in arrears meaning at the end of the year in Florida and are not assessed until November of the year for which they are due. The actual amount of the taxes is 477965.

Common Florida Seller Closing Costs. That sum is prorated based on the date on which the purchaser assumes ownership. As will be covered further appraising property billing and collecting payments conducting compliance measures and clearing discord are all reserved for the county.

Property Taxes in Florida. The way in which these charges are being split is based upon the county in which the property is located in and the contractual terms negotiated in your Purchase and Sales agreement. As stated before the property taxes in Florida are based on the amount required in the previous year.

Neither party is responsible for 100 of the closing costs in Florida which includes fees taxes insurance costs and more. For the median home value in Florida 388635 1 thats between 23290 and 34980. Of course depending on the county you live in your.

Use our Florida seller closing costs calculator to see how much youll owe at closing. In most cases your closing costs will come out of your sales proceeds but theyre only a portion of what youll pay at closing. How Are Real Estate Taxes Prorated At the Closing.

The buyer typically pays between 3 to 4 of the home loans value and is responsible for the bulk of the fees and taxes. When youre ready to close let us handle the details for you. At closing the parties usually sign a re-proration Agreement agreeing to re-calculate the taxes owed.

A millage rate is one tenth of a percent which equates to 1 in taxes for every 1000 in home value. Florida is ranked number twenty three out of the fifty states in order of the average amount of property. The documentary tax stamp rate is standard across Florida at 070 for every 100 of the homes purchase price.

Then when the actual tax bill arrives the buyer and seller pay or are refunded the difference. 9 closing costs for a home that sold for that amount would come to 22680. After a home sale closing is the final stage of the home-buying process.

Counties in Florida collect an average of 097 of a propertys assesed fair market value as property tax per year. How Much Are Closing Costs in Florida. For a 388635 home the median home value in Florida youd pay around 6216.

The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. Settlement or closing fee The settlement or closing fee is paid to the title company for their services on closing day and usually ranges anywhere from 300 to 600 in lower cost counties to 600-900 in higher cost counties. But keep in mind this isnt a hard and fast rule as both parties may negotiate other concessions.

Our goal is to always provide you with the best real estate closings in Florida. The seller usually pays between 5 to 10 of the homes sale price. Property Tax Closing Costs in Florida How to Calculate the Required Amount.

Prorate the taxes if necessary. Tax amount varies by county. A number of different authorities including counties municipalities school.

If you add in Florida real estate commission which is typically 6 of the sale price closing costs in Florida can range up to 9 of the final sale price. For perspective the median home value in Florida is just over 252000 according to Zillow. To address this buyers are credited with the amount of tax for which the seller would otherwise be responsible in the current year.

The tax is calculated by multiplying the amount of the obligation secured by Florida real property by 0002.

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Making An Offer On A Condo Nyc Hauseit Condo Buying A Condo Nyc

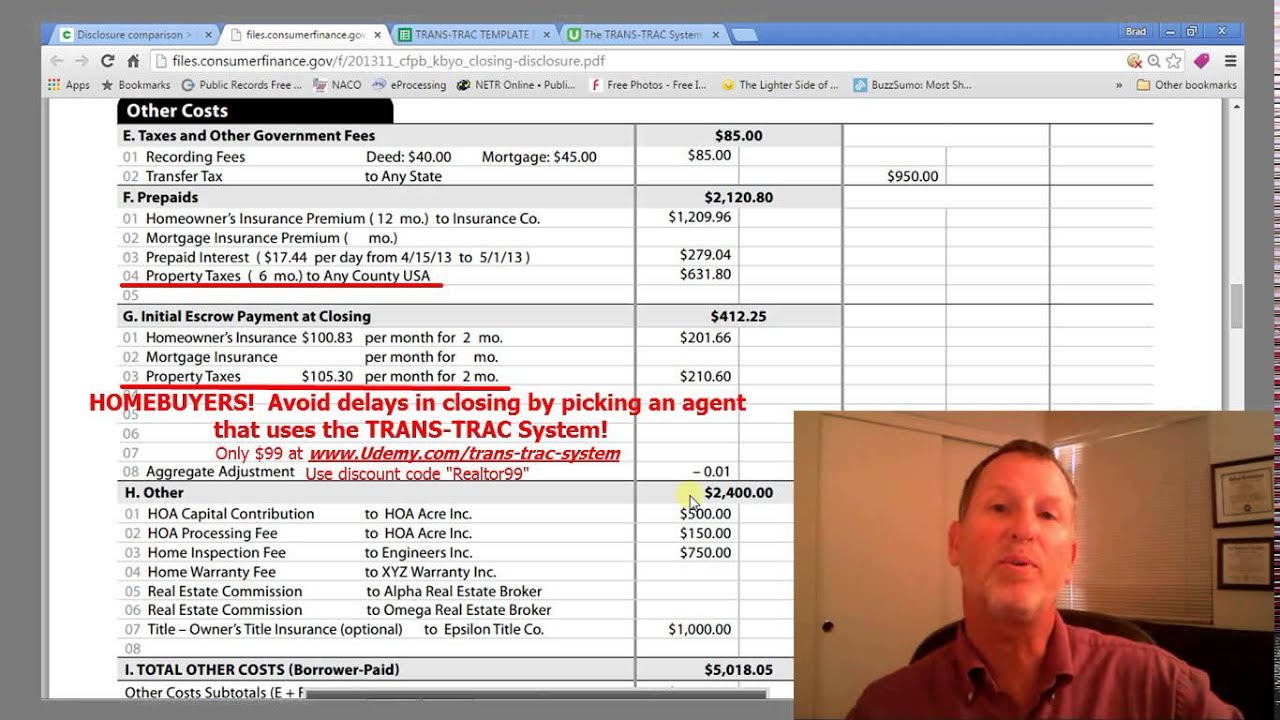

Property Taxes Explained On Closing Disclosure Youtube

Closing Costs For Home Buyers And Sellers Your Realtor For Generations Cheryl Facione Crs Gri Coldwell B Real Estate Tips Real Estate Investing Real Estate

What Should Homebuyers Ask Themselves Before Entering The Market Real Estate Buying Real Estate Buyers Home Buying

Property Tax Prorations Case Escrow

Closing Costs In Florida What You Need To Know

Midpoint Realty Cape Coral Florida Brochure Call Us 239 257 8717 Or Email Admin Midpointrealestate Com Condos For Sale Cape Coral Florida Cape Coral

What Is Included In Closing Costs In Florida Mjs Financial Llc

Your Guide To Prorated Taxes In A Real Estate Transaction

Escrows Prepaids At Closing What You Should Know U S Mortgage Calculator

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

Thanks Diane And Danny For Your Feedback We Appreciate Your Trust In Us And Look Forward To A Lifetime Relat Investing Investment Group Real Estate Investing

First Time Home Buying From A First Time Home Buyer Buying First Home Home Buying Process Home Buying Tips

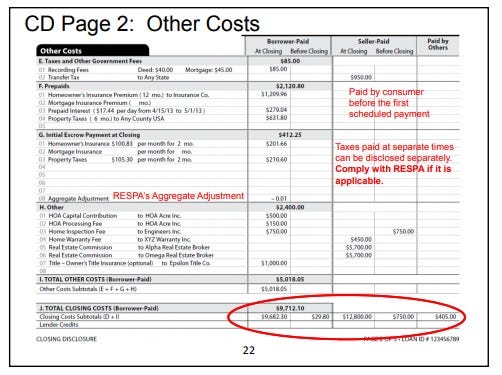

Wtf Is The Aggregate Adjustment On My Closing Disclosure By Jeffrey Loyd Medium

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

Closing Costs That Are And Aren T Tax Deductible Lendingtree